the sales pitch...with a sprinkling of fairy dust

'Become the outright owner' - clearly untrue!

It is neither shared nor owned. It is a leasehold property where the 'owner' is a tenant and is required to pay 100% of 'shared' costs.

House builders, which include housing associations, talk up leasehold as home ownership when it comes to selling the long lease agreements, but are quick to remind buyers that they are in fact tenants when it comes to paying up service charges or dealing with disputes.

Obtaining a mortgage for shared ownership can be more complex as often there are issues with the length of existing leases and the cost of extending. Older leases are set at a maximum of 125 years. New build properties have extended leases and initial 10 year warranties on repairs.

Accent 'homemade' recommend Metro Finance - a company specialising in mortgages for shared ownership

Shared ownership is not only brilliant. 'It is super brilliant'.

No mention that you can only own up to 75% and will never own the freehold.

No mention your home can be repossessed for failure to pay charges over which you have no control.

No mention the HA have first option to sell.

You do not own the property - ever

Shared Ownership Resources is an independent online platform for shared owners, homebuyers, housing professionals and anyone with an interest in affordable housing.

It has recently published ‘Shared Ownership: The Consumer Perspective’ the first review of the shared ownership scheme to focus exclusively on the consumer perspective based on the experiences of shared owners themselves.

'It is not ownership'

'The name shared ownership is probably about as wrong as it possibly could be in crucial respects: its costs are not shared and in very definite effects it is not ownership.'

His full assessment of the industry can be read here;

the truth hurts...

Shared ownership is not an investment. You cannot sublet. You are responsible for paying for all communal charges over which you have no control. You are not covered by any consumer protection. Regulation is weak and is strongly biased in the landlord's favour. As rent goes up with the RPI plus 0.5% you can not negogiate this.

You pay rent on the part you don't 'own' and your home can be re-possessed with no return of equity.

If you were to buy a property with a value of £200,000 with a 50% 'share'and install a new kitchen and bathroom after one year; you could easily lose £14,000 on that initial investment.

'It is possible on a £1 million shared ownership flat in London, where you might have a 25% share, that you could lose it all on two months’ rent arrears.'

Shared Ownership - Face negative equity

'Vulnerable tenancy arrangement'

The Advertising Standards Authority ruled recently that the tag line used in selling shared ownership describing it as;"home ownership starts with us" was over-stating a vulnerable tenancy arrangement.

Service standards and charges rely entirely on the integrity and professionalism of those managing leasehold properties. There are some reputable companies operating but in general the system is so poorly regulated it is abused by many managing agents including housing associations.

Shared Ownership - personal problems

"That’s an issue with shared ownership, you have so little control over the issues of the building itself.'

'Sellers must accept the RICS valuation rather than go with the estimate of an estate agent. Any shortfall between the sales price and the valuation has to be paid by the seller to the housing association, and this applies on the entire house price rather than just the percentage they own.'

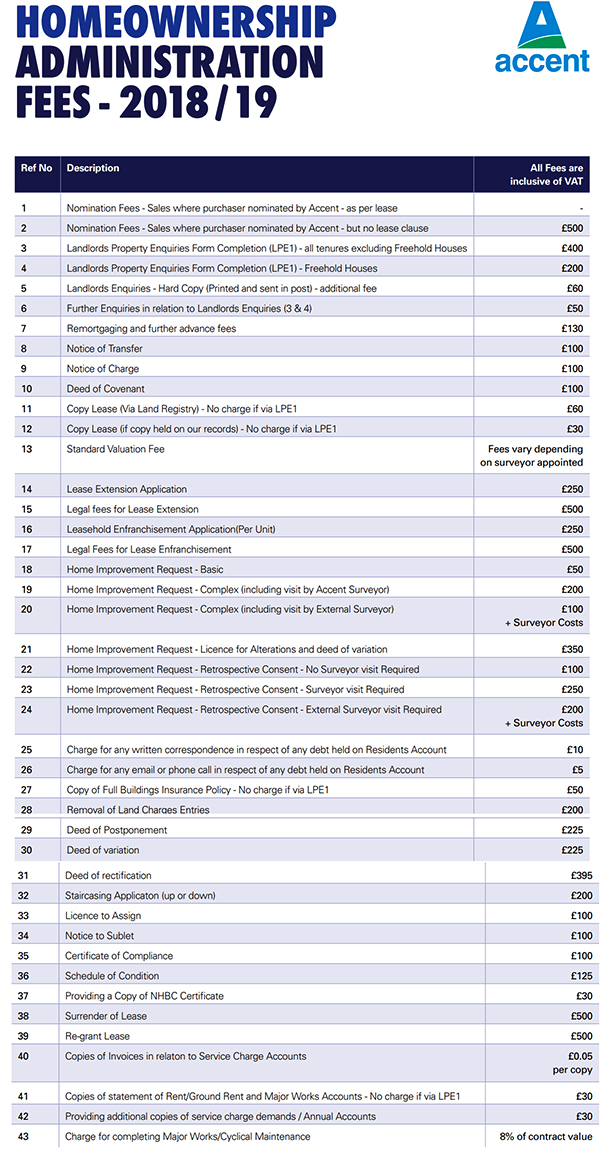

Administration charges come on top of your service charges and are often difficult to assess.

The contract for window replacement at Lambert Court was worth approximately £100,000. An external planning consultant was brought in to oversee the project at a cost of £3,000 and all the work was outsourced to third parties.

Despite having minimal input into any 'management' of the project Accent Housing could legally charge an administration fee of 8% on top of this work.

Accent Housing atempted to charge a 15% 'management fee' until residents drew attention to it.

Building safety Act 2022

Due to the way it has been drafted if leaseholders carry out a lease extension now you could lose the protection provided under that act. Shared owners are more likely to fall foul of this due to the short nature of many leases resulting in significant building safety costs being charged to residents. Legal advice would be recommended before undertaking such a move.

Websites with lots of helpful information including the latest rulings on EWS1 forms include;

Leasehold Knowledge Partnership

Feudal history of leasehold - The House of Haccent