Reliance on external auditors

Leaseholders normally receive a statement of factual findings which accompanies their end of year statements relating to service charges. (Unless the lease dictates otherwise).

This statement provides no reassurance whatsover as to whether charges are genuine, reasonable or free from mis-statement.

The only inference that can be drawn from it is that Accent Housing have paid an invoice presented to them.

Accent Housing persistently use the fact that 'accounts' are externally certified believing that, somehow, this legitimises them. This argument runs through all First Tier Tribunal defences and is consistently presented to residents when service charges are questioned.

That is complete nonsense and has to be seen as such.

'SYSTEMATIC' overcharging to Lambert Court has all been 'certified'.

Both Grant Thornton and Beevers and Struthers have produced factual findings for Lambert Court. Stephenson Smart and Co. have produced the section 21 summary on three occasions.

Not a single instance of incorrect charges being applied has ever been identified and yet residents have been refunded over £30,000.

It is only through resident intervention that any 'overcharging' is ever exposed.

External accountants will not identify overcharging, inflated invoicing or mis-statements because it is not within their remit and is not the purpose of an agreed upon procedure. It relies on the integrity and professional diligence of those at Accent Housing to identify those in their 'self-certification'.

They never have.

Lease Lambert Court:

Simply put; charges to each resident have to conform to the lease and be in connection to the actal work incurred on the estate.

Accent Housing persistently ignore this fact hiding behind 'global' contracts and Long term qualifying agreements. Hence the present challenge reaching the supreme court over a tiered management fee unrelated to the conditions of each lease.

Comparison of service provisions.

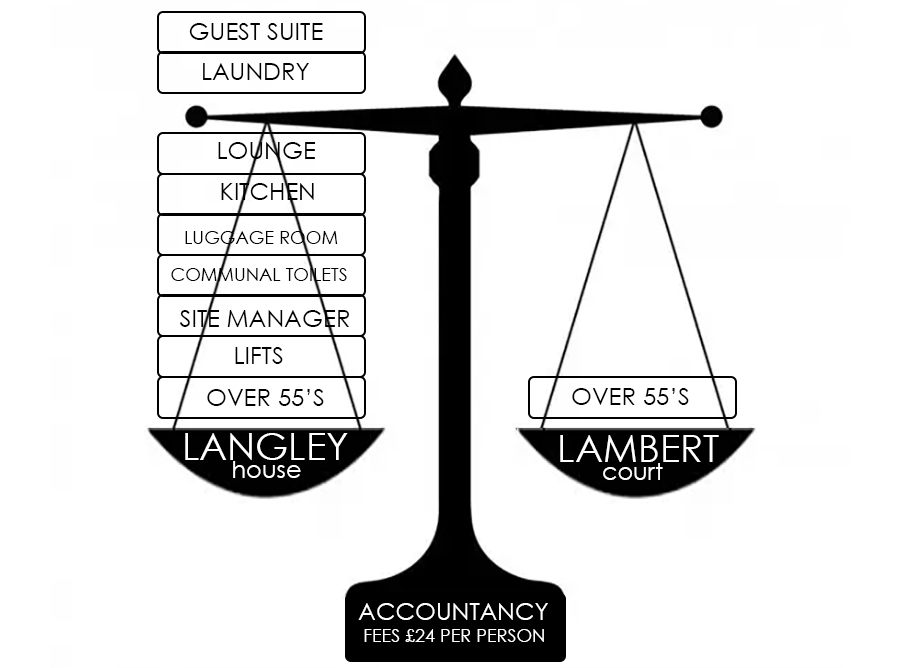

Langley House in York left Accent for the right to manage. It is a much larger estate with a multitude of services unlike Lambert Court which has no facilities.

The only thing that Lambert Court have in common with Langley House is an age restriction and yet residents at Lambert Court paid the same charge for 'accountancy' work as those at Langley House.

Langley House paid £28,500 in management fees. Lambert Court paid £9,000. How is it residents on both estates pay the same accountancy charge when it is clear that the administration of each estate is so different?

Does this equate to the conditions of each lease where work has to be 'connected' to the estate?

On leaving Accent Housing the accountancy bill for Langley House has gone from £26.90 per resident to under £5.

Lambert Court will make the same savings when they adopt the right to manage.

Since 2019 Beevers and Struthers have charged a flat fee per unit across the entire Accent Housing portfolio with no connection as to the actual work undertaken on each estate. A single global invoice from Beevers and Struthers is the sole document produced under the section 22 request that underlies accountancy charges.

How Accent attempt to justify charges.

The extract below is taken from an email sent by Sarah Ireland to a resident on another estate 'managed' by Accent Housing and who face similar ongoing problems.

Email from Sarah Ireland

In terms of financial controls, our accounts are produced in accordance with UK applicable law and UK Accounting standards. Our external auditors formulated their opinion with reference to International Standards on Auditing (ISA’s).

They are required to report by exception on a number of matters, one being that there is a satisfactory system of control over transactions and the second being that the parent society has maintained proper accounting records.

The external auditors have never had cause to report on these matters.

Internally we undertake regular internal audits of our systems and processes with purchase to pay being one aspect which is on a recurrent cycle. All recommendations for improvement are reported to the audit and risk committee and monitored actively by management.

Sarah Ireland

It is a disingenuous attempt to present a statement of factual findings as a guarantee that service charges are genuine and free from mis statement.

There is no 'system of controls over transactions' as was proven by the systematic overcharging at Lambert Court.

There is no 'regular audit on purchases to pay' as shown by the fact that every inflated invoice presented by ESH construction was approved.

False reassurances are being delivered here. This is a recurrent but meaningless mantra. The weak consumer regulation only encourages this practice.

Audit

An audit provides a high level of assurance – that is, evidence-based that the accounts as a whole are free from material mis-statement, whether due to fraud or error.

Accent Housing have claimed accounts at Lambert Court receive an audit. They do not.

'At the end of the year the final costs are detailed and the accounts audited to provide a definitive record of the expenses ACTUALLY spent during the year.'

'accounts are subjected to Audit'

Robert Bloom Head of leasehold email 15/03/2021

Clearly untrue and again simply provides false reassurance.

Factual Findings

Service charge accounts are prepared by the landlord and not by a registered auditor. They are passed on to an external auditor who then provides a statement of factual findings based on relatively limited procedures.

The most essential thing an external accountant has to do is obtain a copy of the relevant lease as this governs and restricts what charges can be applied.

Accent Housing will not confirm whether any accountant has ever received a copy of any lease prior to engagement despite various residents raising this issue.

Emails from David Royston former Chief financial officer simply confirm that: 'The certification process took place based on a selection of sample leases'.

Robert Bloom, in defending service charges, has produced quotes from a lease unconnected to Lambert Court which is concerning.

Robert Bloom is head of sales and homeownership.

Where expenditure represents an allocation of an expense across one or more service charge schemes the accountant has to obtain written confirmation from the landlord that the allocation is in accordance with the lease. Global invoicing is used as a basis for charges to each estate for multiple service provisions with no evidence of what work is connected to each estate. A breach of the lease and yet the auditor does not draw attention to this.

I have copies of emails from David Royston former Executive Director of finance:

'we do not capture costs at individual scheme level, but the total costs incurred by Accent and divided by the total number of properties managed..."A clear breach of lease conditions.

The report on factual findings is meant to be for the landlord only and for no other purpose and yet it is presented to all residents by Housing Associations as some form of reassurance.

The work is carried out having regard to [TECH 03/11[16]] (Part of the Residential Service Charge Accounts). What this means is that the accountant cannot express any assurance on the service charge accounts.

The ONLY assurance the external accountant can provide are.

The figures in the statement of account (factual findings) have been extracted correctly from the accounting records and were supported by receipts. There is no guarantee any receipts are inspected.

Meaning: Accent Housing can charge whatever they wish. Contractors can inflate costs and fabricate work. Provided an invoice can be produced all is well.

This is what Accent Housing and all other Housing Associations use to legitimise service charges.

The statement of factual findings which residents receive does not express a conclusion, and therefore it is not an assurance engagement in the technical sense.

It does not provide recommendations based on the findings.

The report is worded so as to restrict access and/or reliance on it to those parties that have agreed to the procedures to be performed since others, unaware of the reasons for the procedures, may misinterpret the findings.

deluge